The smart Trick of Stonewell Bookkeeping That Nobody is Discussing

8 Simple Techniques For Stonewell Bookkeeping

Table of ContentsSome Known Incorrect Statements About Stonewell Bookkeeping Stonewell Bookkeeping Things To Know Before You BuyRumored Buzz on Stonewell BookkeepingThe Ultimate Guide To Stonewell BookkeepingThe Best Strategy To Use For Stonewell Bookkeeping

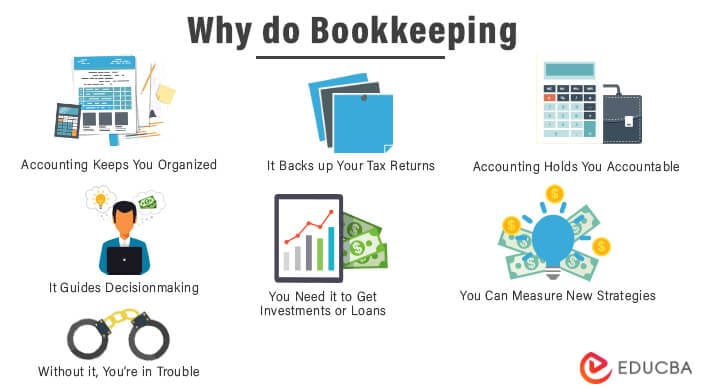

Below, we respond to the inquiry, exactly how does bookkeeping assist a service? The true state of a firm's financial resources and cash circulation is always in flux. In a feeling, bookkeeping publications represent a picture in time, but only if they are upgraded commonly. If a company is absorbing little bit, an owner should take activity to enhance revenue.

None of these final thoughts are made in a vacuum cleaner as factual numerical info must strengthen the monetary choices of every small service. Such data is compiled through accounting.

Still, with proper money circulation monitoring, when your publications and journals are up to day and systematized, there are much less enigma over which to worry. You understand the funds that are readily available and where they fall short. The information is not constantly good, yet at least you recognize it.

Not known Details About Stonewell Bookkeeping

The puzzle of reductions, credit histories, exemptions, timetables, and, obviously, charges, suffices to merely give up to the internal revenue service, without a body of well-organized paperwork to support your claims. This is why a committed bookkeeper is invaluable to a small organization and deserves his or her weight in gold.

Those philanthropic contributions are all enumerated and accompanied by details on the charity and its settlement info. Having this information in order and nearby allows you file your tax return easily. Keep in mind, the federal government doesn't fool around when it's time to file taxes. To ensure, a business can do every little thing right and still be subject to an IRS audit, as many currently understand.

Your organization return makes insurance claims and depictions and the audit aims at validating them (https://www.dreamstime.com/stonewellbookkeeping77002_info). Good bookkeeping is all concerning linking the dots in between those representations and fact (small business bookkeeping services). When auditors can follow the details on a ledger to receipts, financial institution statements, and pay stubs, to call a couple of files, they swiftly learn of the proficiency and honesty of business company

The Buzz on Stonewell Bookkeeping

In the very same means, careless accounting includes in stress and anxiety and anxiousness, it additionally blinds company owner's to the possible they can understand over time. Without the info to see where you are, you are hard-pressed to set a destination. Only with reasonable, in-depth, and accurate data can a company owner or management group story a training course for future success.

Entrepreneur know best whether a bookkeeper, accounting professional, or both, is the appropriate remedy. Both make crucial payments to an organization, though they are not the same career. Whereas a bookkeeper can collect and organize the details needed to sustain tax preparation, an accountant is much better fit to prepare the return itself and really analyze the revenue declaration.

This article will certainly dig right into the, including the and exactly how it can profit your business. Accounting entails recording and organizing monetary purchases, including sales, acquisitions, settlements, and receipts.

By consistently upgrading economic records, bookkeeping assists services. This assists in easily r and saves services from the stress of searching for files during deadlines.

All About Stonewell Bookkeeping

They are mainly concerned concerning whether their money has actually been utilized appropriately or not. They certainly desire visit their website to understand if the company is earning money or not. They additionally would like to know what potential the company has. These facets can be easily managed with accounting. The revenue and loss declaration, which is prepared frequently, reveals the revenues and also determines the prospective based upon the profits.

By maintaining a close eye on economic records, organizations can establish practical goals and track their development. Routine accounting makes sure that services remain certified and stay clear of any charges or legal problems.

Single-entry bookkeeping is straightforward and functions finest for small businesses with couple of deals. It does not track assets and responsibilities, making it less comprehensive contrasted to double-entry bookkeeping.

The Best Strategy To Use For Stonewell Bookkeeping

This could be daily, weekly, or monthly, depending on your business's dimension and the quantity of deals. Don't think twice to seek assistance from an accountant or bookkeeper if you find handling your economic documents challenging. If you are trying to find a complimentary walkthrough with the Accountancy Option by KPI, contact us today.